Robinhood is a broker that lets you buy and sell stocks for zero commission. They do that by selling your order to 3rd parties who get a free look at it before taking the other side themselves or passing it along to the market.

Executing your order isn’t an expense for them; it is a revenue item. If you aren’t worried about other firms seeing your order or possibly not getting the very best price (they have to fill you at the best bid or offer, so it shouldn’t be too far off what you could get if you had more control over the order), then the free trades are worth it.

You get what you pay for, so executions in fast markets might be slow, but it works for traders that are just accumulating positions over time and don’t care much about price or being able to trade in tight markets.

Why Should You See A Robinhood Alternative?

If you are moving out of Robinhood or either looking out for some better options, you should look for Robinhood alternatives. Generally, there are some points where you can relate the factors, but you will like these options as well:

➥ You are New To Investing

Robinhood and its alternative apps are geared toward new investors, perfectly fitting their store. It is a platform for all new investors to cater a chance to learn new forms and resources.

Its alternative is an application where investors are more comfortable, would not gain any more losses, and will get to learn how to invest in the stock market at what time and with what shares.

Read Also: How To Withdraw Money from The Robinhood

➥ Want Free Trading

Free trading means zero commission charges applied to your transaction. Robinhood sets a bar with free investing, especially with newcomers.

The platform sets will start you off in the right direction.

When you start your trading journey, search for no-commission brokerage applications because it would help save your money in the starting. Hence, Robinhood alternatives would be the most suitable for you.

➥ More Accessible and Smoothly Running Applications

We quickly get fed up with things that don’t work effectively, especially while we are making any transactions online. For this, an easy-to-use application that completely hands off like a robot is the alternative application to Robinhood, which will make your day better.

Though Robinhood is the best application, there are other alternatives to watch them. Here are some best options you can use and get started with help.

What Features Might You Look For In A Robinhood Alternative?

Here are some essential things one should end up looking at in Robinhood alternatives are:

➥ Commission Fee

You must find a platform with no commission or bearable fee. Usually, there will be some kind of charges involved like standard SEC, but most of it, you can find alternatives with no commission fees involved; it will be easier for you to begin with trading.

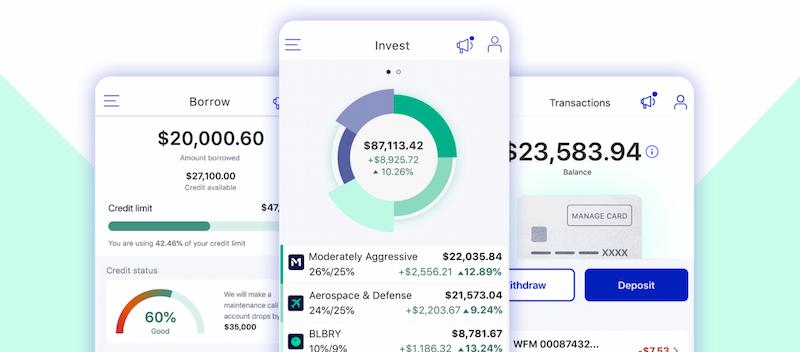

➥ Mobile Application

An alternative to Robinhood should be a mobile application brokerage user means they should function on their application well. A website is also an option but preferably a lookout for something that has a mobile app. Because mobile apps are easy to navigate and use, it helps to understand quickly and has some type of news section which grants you to invest in which sector.

➥ It Should Have An Extra Account Option

You must look for extra account options such as checking or savings account examples; Betterment and Stash and many others are jumping towards it to start this excellent feature that helps the users operate.

The reason is beneficial instead of checking somewhere else; it is better to fit within our account.

10 Best Alternatives To Robinhood App

- M1 Finance

- E-Trade

- Betterment

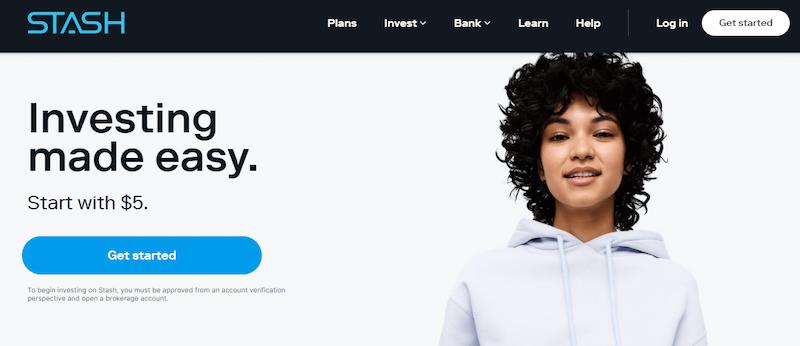

- Stash

- Webull

- TradeStation

- SoFi Active Investing

- TD Ameritrade

- Public.com

- Interactive Brokers

M1 Finance

The company specializes in helping investors choose a ready-made portfolio. While M1 Finance can offer a “pre-build pie” of a similar group of shares, Vanguard has created 100 top dividend shares investment fund and ETFs as a management fee. M1 is a simple platform ideal for anyone who wants to invest.

Though automated M1 Finance is a brokerage providing a hybrid Robo investing service with the ability to choose your investments brokerage, if you want to be hands-off but still with a say in your investments, M1 Finance is the perfect bridge between Robo and DIY investing.

Then comes the automated service that will manage your account. However, virtually every other brokerage offers these kinds of services, and remember- it’s your investment choices that make or break your account- NOT the brokerage that holds them.

E-Trade

If you are looking for an industry leader in e-commerce that can help you learn more about investing, e-TRADE is an excellent option. ZacksTrade offers one interface for experienced traders and one for newcomers. Expect a fee-free experience. Seeking a platform that allows you to manage your investments at an affordable price actively, you should look at what ZackTrade offers.

Betterment

The easiest way is with a Robo-adviser such as Betterment. It doesn’t matter if you’ve been investing for years or just opened your first account a few months ago. With a handy app that offers services at low fees, even experienced investors can easily save money and improve their portfolios—one of the pioneers in investment apps.

It is said to be a good replacement application for Robinhood because of the simplicity they serve to the users. Also, it offers a unique feature such as checking and saving accounts called Cash accounts at absolute zero cost. When you first open the app, questions will help the Betterment understand how much risk tolerance you can bear.

Stash

Earnings drive stock prices, and you can use Stash Invest to invest in fractional shares of big companies that make a ton of money. The fractional share option makes expensive stocks like Amazon and Alphabet accessible to the average investor.

Stash shows the historical performance of several stocks & ETFs to give you a general background on what you are buying. The past doesn’t indicate any future numbers, but a company with solid earnings in history has a good chance of staying profitable.

Plus, you pay zero commission fees to trade as often as possible without racking up fees. Every beginner makes mistakes, and it’s nice to be able to buy and sell without paying a ton of expenses. An essential investment account only costs $1 per month. Stash invest is the perfect app for beginner investors who want to start the stock market and learn how everything works.

Webull

Webull offers an excellent opportunity for active traders with limited resources. You’ll have access to the best trading platform in the market, and there are no deposits or fees involved!

Webull is an excellent choice if you want to trade stocks day-to-day but don’t have enough capital. There are also no depositing requirements – so it could be perfect for someone who wants something simpler than Robinhood.

Webull is an innovative company that focuses on meeting the needs of young investors. Webull provides a social experience you won’t find on other online trading platforms and has easy-to-use features for beginner traders. For more advanced investors, Webull is the best choice.

Frequently asked questions (FAQ)

It all depends on how proficient a trader you are and how well you understand stock trading. Robinhood is an easy-to-use platform that makes investing simple, easy, and even fun. However, the downsides of Robinhood are that it gives limited charts and basic information about companies.

The beauty of Robinhood is that you are charged no commission when buying and selling shares of stock, ETFs, or options on them.

It’s difficult to say, but we will try to figure out some points.

Fidelity is a brokerage where you would buy stocks in a mutual fund that you plan to leave alone for at least 5 yrs. Fidelity is a popular brokerage for companies to set up their employees.

On the other hand, Robinhood has a clean and straightforward interface. Functions like 100 Most Popular are helpful as it allows you to see what other people are purchasing. It offers a cash management account which means you get paid for interests, but the interest rate they offer is not highly competitive compared to some of the big banks.

Final Thoughts

Hopefully, this article helped you not only in one way but several ways, such as apps better than Robinhood, an overview of Robinhood alternatives, and many more. We aim to convey the best message that could help your decision to shift from one to another. Remember, no brokerage will be the same, so pick wisely. It must offer some unique features and guide you with your portfolio investments.